top of page

Annual Reports in Estonia: What e-Residents Need to Know

Every Estonian company must submit an annual report, regardless of activity level.

This obligation applies equally to e-Residents.

What Is an Annual Report?

The annual report summarizes:

- financial activity (or lack thereof),

- assets and liabilities,

- management confirmation.

Even companies with zero activity must submit a report.

Inna Mrachkovska

Feb 42 min read

How to Open a Business in Estonia as an e-Resident

How to Open a Business in Estonia as an e-Resident

Estonia offers one of the most transparent and digital business environments in the world. For e-Residents, it allows company management fully online - regardless of physical location.

However, digital access does not remove responsibility.

Inna Mrachkovska

Feb 12 min read

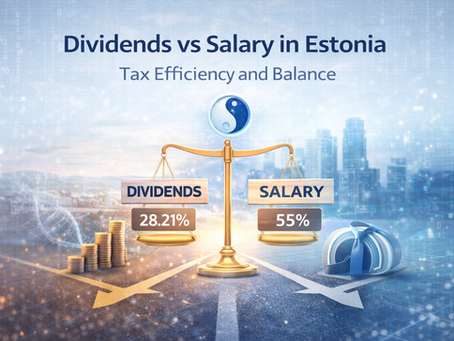

Dividends vs Salary in Estonia: Tax Efficiency, Balance and Business Identity

For e-Residents running Estonian companies, it is essential to understand the difference between dividends and salary from a tax perspective - not as a formula, but as a strategic decision.

In Estonia, the numbers speak clearly:

Salary may cost up to 55% when all employment-related taxes are considered.

Dividends result in an effective tax burden of approximately 28.21%.

The difference is significant.

However, this does not mean that choosing only dividends or only

Inna Mrachkovska

Jan 202 min read

Annual Financial Reporting in Estonia: What to Prepare for 2025

As 2026 has begun, the new annual financial reporting period is officially open.

This is a friendly reminder for e-Residents of Estonia and Estonian tax residents - both current and new clients - to start preparing documentation for the 2025 financial year.

Annual reporting does not have to be stressful if preparation begins early and information is collected gradually.

Inna Mrachkovska

Jan 162 min read

bottom of page