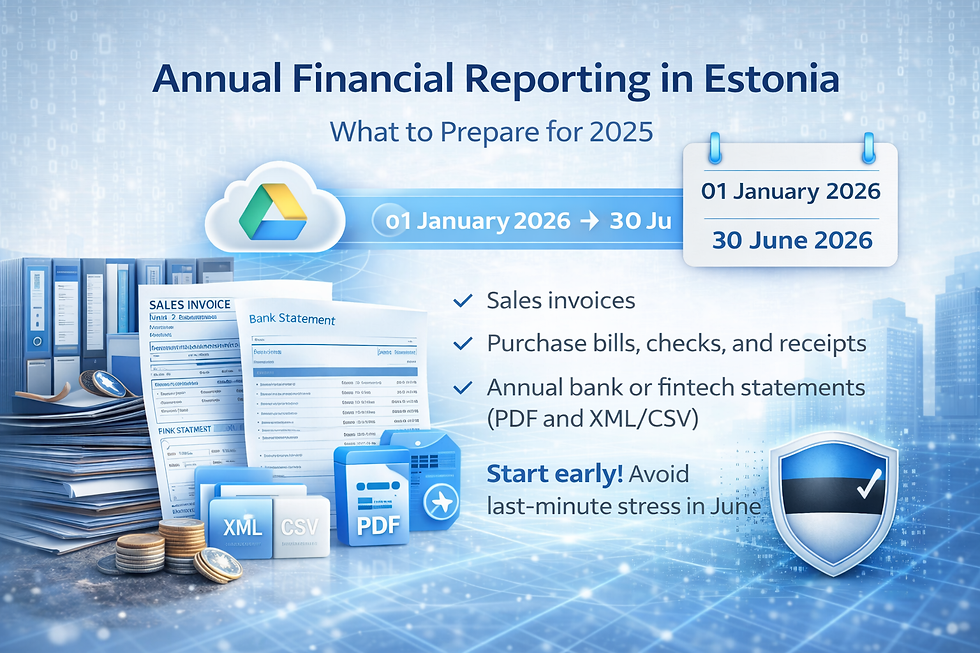

Annual Financial Reporting in Estonia: What to Prepare for 2025

- Inna Mrachkovska

- Jan 16

- 2 min read

As 2026 has begun, the new annual financial reporting period is officially open.

This is a friendly reminder for e-Residents of Estonia and Estonian tax residents - both current and new clients - to start preparing documentation for the 2025 financial year.

Annual reporting does not have to be stressful if preparation begins early and information is collected gradually.

What to Do First

Please review your data for 2025 and begin collecting copies of your documents in a dedicated folder (for example, in Google Drive). You are welcome to invite me to prepare and submit your annual report once your documents are ready.

We, as professionals, are here to support you, especially if you do not have the time, interest, or technical knowledge to process financial data on your own.

Documents Typically Required

For annual reporting, we usually request the following:

Sales invoices

Purchase bills, checks, or receipts

Annual bank or fintech statements

PDF format

XML / CSV format (where available)

All documents must be clear and readable, meaning that both you and your accountant can open the file and understand what information it contains.

Each document is reviewed individually. Reading, verifying, and clarifying financial data is a core part of professional accounting work.

Reporting Timeline

The annual reporting period runs from:

01 January 2026 → 30 June 2026

There is no immediate rush, but please be aware that waiting until June is strongly discouraged.

The final weeks of the reporting period are extremely busy. Last-minute submissions create unnecessary pressure and stress - not only for accountants, but also for clients themselves.

Starting early allows the process to remain calm, accurate, and predictable for everyone involved.

I wish you a productive, stable, and growing year ahead. May 2026 bring clarity, balance, and progress in all the ways that matter to you.

Comments