top of page

Dividends vs Salary in Estonia: Tax Efficiency, Balance and Business Identity

For e-Residents running Estonian companies, it is essential to understand the difference between dividends and salary from a tax perspective - not as a formula, but as a strategic decision.

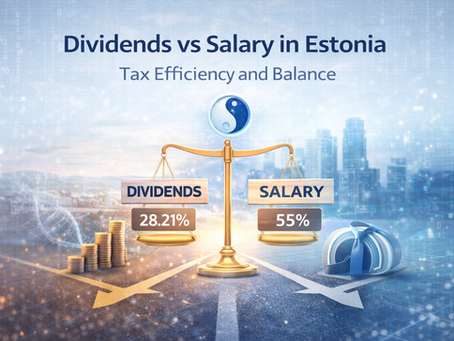

In Estonia, the numbers speak clearly:

Salary may cost up to 55% when all employment-related taxes are considered.

Dividends result in an effective tax burden of approximately 28.21%.

The difference is significant.

However, this does not mean that choosing only dividends or only

Inna Mrachkovska

Jan 202 min read

bottom of page